Russia is Moving Up!

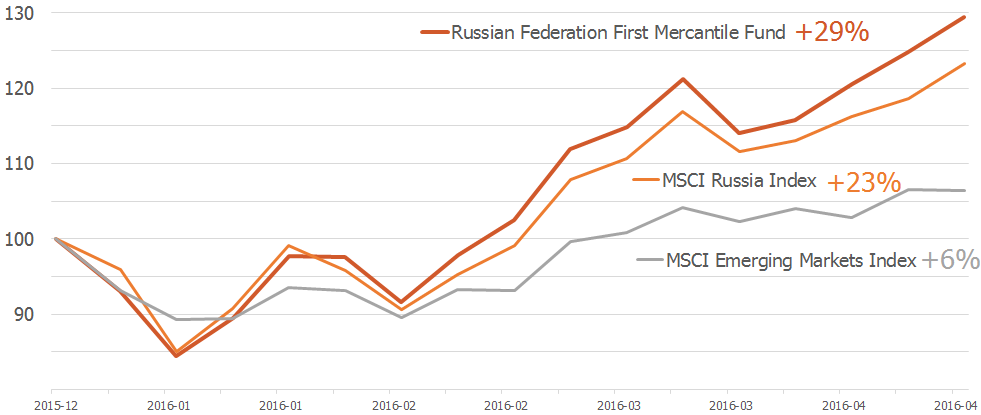

Russian Federation First Mercantile Fund BMG3474A1190, MSCI Russia Index and MSCI EM Index 2015-12-31 to 2016-04-22, data source: Bloomberg.

After a somber Q4, the Fund rallied 29% in the first 3 months of the year, following what was a pick-up in oil prices and EM sentiment in general. At the macro level, the FinMin is expecting a budget deficit of 3% of GDP at an average price of $40/bbl Brent Crude, coupled with a 0.3% GDP decline in 2016. Assuming a stable oil price and no geo-political tensions, these numbers can be achieved. A lot of institutions are underweight Russia – we think this is wrong. Investors in Russia have been accustomed to tail risks such as the 1998 RUB crisis or the 2013 Crimea annexation. Those aside, Russia is trading at a considerable discount to EM peers. Finally, a quick comment on the political scene in the up-coming US Presidential elections, which is crucial for Russian economic framework. According to one of our managers, should two particular candidates be elected (one from each party), it could trigger a multi-year rally equivalent to 3x current levels in Russia equities.