THE WORLD’S FASTEST GROWING ECONOMIES

Million People

Emerging Regions

%

of World Population

FMG RISING 6 FUND

THE RISING 6 AT A GLANCE

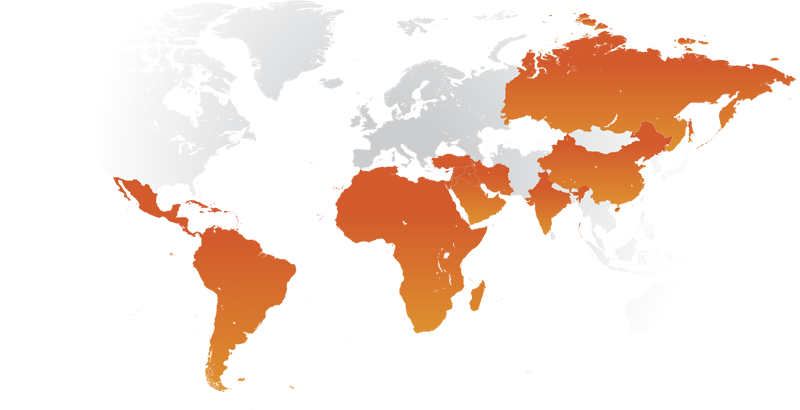

The FMG Rising 6 Fund aims to attain exposure to the world’s fastest growing economies which include: Asia/China, India, Russia, the Middle East, Africa and Latin America. These countries and regions are growing at a much faster rate than developed economies. They make up more than 50% of global growth, but only represent 20% of the world’s stock market capitalisation.

• Nearly 4 billion people, some 60% of the global population

• Covers about half the world’s land mass

• A majority of the population is under the age of 25

• Growing middle class with increased appetite for consumer goods

FUND DESCRIPTION

The fund invests in liquid securities to be able to rotate in and out of these markets efficiently. FMG considers risk management an integral element of the portfolio management process. The Rising 6 Fund is open to retail and institutional investors seeking a higher risk-reward return profile. The fund is daily traded and UCITS compliant, making it an ideal investment for a broad exposure to emerging markets.

MOST RECENT POST

FMG (EU) Rising 6 Fund lost 3.8% in the 2nd Quarter of 2017

FMG (EU) Rising 6 Fund lost 3.8% in the 2nd Quarter of 2017 The FMG Rising 6 Fund had a disappointing second quarter in 2017, but still ended the first half of the year in positive territory. The general upward trend in Emerging Markets continued, with...

ASSET ALLOCATION

- India 24%

- Cash 19%

- MENA 16%

- Africa 16%

- China 9%

- Russia 7%

FUND PARTICULARS

Investment Focus

Investment Objective

Investment Horizon

Risk Level (1-7)

Management

Fund Structure

Fund Type

Inception

Base Currency

Currency Classes

Minimal Init. Investment

RIC, Africa, MENA & LatAm

Listed Equities

3-5 Years

6

Multi Managed

SICAV

UCITS

2011

USD

USD, EUR, GBP, SEK, NOK, JPY

Class: R USD 100, I USD 1,000,000

Prenotice (Buy)

Prenotice (Sell)

Cut-off Time

Load Fee

Annual Management Fee

Income Distribution

Domicile

Regulator

Custodian

Administrator

Audit

1 Business Day

1 Business Day

4:00PM CET

Up to 5%

Class R: 1.75%, B: 1.0%

Accumulation

Luxembourg

CSSF

ING

Apex Fund Services

Deloitte

Info Sheet

Fact Sheet

Presentation

Prices/NAV’s

Key Investor Information Document (KIID) for Class R USD

Documents for fund classes R & I in USD, EUR, GBP, SEK, NOK and JPY are available in English and Swedish. Inquire below

Inquiring more information or subscription details - Rising 6 Fund

Disclaimer: FMG (MALTA) Ltd. (“FMG”) is licensed by the Malta Financial Services Authority (“MFSA”) as a category 2 Investment Services Provider as provided in the Investment Services Act Chapter 370 of the Laws of Malta. FMG is authorized to act as a full scope alternative investment fund manager (“AIFM”) in terms of Directive 2011/61/EU of the European Parliament and of the Council on alternative investment fund managers (“AIFMD”). This summary is for information purposes only and does not constitute an offer to sell or a solicitation to buy. Citizens or residents of the United States and India may not invest in these Funds. All Funds may not be marketed to Swiss citizens or residents except those considered as “regulated qualified investors” by the Swiss Collective Investment Schemes Act and the Swiss Collective Investment Schemes Ordinance. All Funds are not to be marketed to EU or EEA investors. Investors who wish to obtain information on these funds will only be provided any such materials upon receipt of an appropriate reverse solicitation request in accordance with the requirements of the EU AIFM Directive, Swiss Law and/or national law in their home jurisdiction. Opinions and estimates constitute the manager’s judgment and are subject to change without notice. Past performance is not indicative of future results. Investments in Emerging Markets should be considered high risk where a portion or total loss of capital is conceivable. The synthetic risk-indicator illustrated herein comprises 60 months returns calculated in USD and is updated once per annum. No assurance can be given that the investment objective will be achieved or that an investor will receive a return of all or part of his/her initial capital, and investment results can fluctuate substantially over any given time period. Please refer to the relative fund’s prospectus which contains brief descriptions of certain risks associated with investing in the fund. Questions should be directed to your local representative or financial advisor. This document may not be reproduced, distributed, or published for any purpose without the prior written consent of the manager. All information contained in this communication is as provided by FMG (MALTA) Ltd. Return chart: FMG (EU) Rising 6 Fund R LU0574464128, MSCI BRIC Index, MSCI EM Index (USD). Data source: Bloomberg. Exposure chart is updated April 2018. FMG Copyright (C) 2022 FMG. All rights reserved.