REACH EXCITING NEW MARKETS

%

of Global GDP

%

of Global Market Cap

Combined Population (bn)

%

of Proven Oil Reserves

ASIA FRONTIER FUND

ASIA FRONTIERS AT A GLANCE

Today’s young people will be tomorrow’s consumers and producers. When one considers the 20 most populous nations, 9 are considered Frontier Markets, 8 are Emerging Markets and only 3 are Developed Markets.

Macro Picture: Strong macroeconomic fundamentals

Debt/GDP: FM 40%, EM 50%, DM 80%

Valuations: Valuations are very attractive

Correlation: Low correlation to EM and DM

Growth: GDP growth forecast (10Y): FM+7%, EM+5%, DM+2%

Demographics: Constitute 40% of the world’s 14 to 25 year olds

INVESTMENT STRATEGY

The Asia Frontier Fund is designed to offer investors high returns which have a lower correlation with global and emerging markets and provide a significant diversification opportunity. The fund universe consists of Asia frontier countries which exhibit favorable demographics combined with rising incomes and high GDP growth rates.

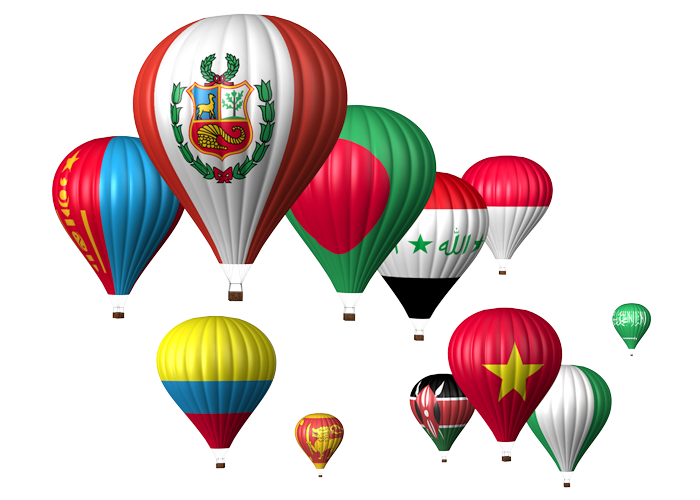

Due to the structural changes taking place in these economies, the fund invests in listed equities of companies that have their principal business activities in these high growth Asian frontier countries. The current fund universe consists of Bangladesh, Bhutan, Cambodia, Iraq, Laos, Maldives, Mongolia, Myanmar, Nepal, Pakistan, Papua New Guinea, Sri Lanka and Vietnam.

MOST RECENT POSTS

Manager Comments Q2 2020 – Asia Frontier Fund

The AFC Asia Frontier Fund (Non-US) (AAFF) USD A-shares increased by 4.2% in April 2020 with a NAV of USD 1,062.41. The fund underperformed the AFC Frontier Asia Adjusted Index (+17.9%), the MSCI Frontier Markets Asia Net Total Return USD Index (+13.1%), the MSCI...

ASSET ALLOCATION

- Vietnam 23%

- Mongolia 17%

- Bangladesh 17%

- Iraq 10%

- Uzbekistan 9%

- Sri Lanka 6%

- Cash 6%

- Pakistan 5%

- Myanmar 5%

- Laos 2%

- Papua New Guinea 2%

- Kazakhstan 1%

FUND PARTICULARS

Investment Profile

Investment Focus

Investment Objective

Investment Horizon

Risk Level (1-7)

Management

Fund Type

Fund Structure

Inception

Base Currency

Minimal Init. Investment

Frontier Markets

Asia Frontiers

Public Equities

Minimum 5 Years

4

Single Managed

Open Ended Investment Company

Segregated Accounts

March 2012

USD

$25,000 or lower when dealt via »»

Dealing

Prenotice (Buy)

Prenotice (Sell)

Cut-off Time

Load Fee

Annual Management Fee

Performance Fee

Income Distribution

Domicile

Custodian

Administrator

Audit

Monthly

5 Business Days

A:90 B:180 Calendar Days

5:00PM ADT

Up to 5%

A: 1.8% B: 1.5%

A: 10% B: 8% (HWM)

Accumulation

Cayman Islands

Deutsche Bank

Custom House

Ernst & Young

Inquiring more information or subscription details - Asia Frontier Fund

Disclaimer: FMG (MALTA) Ltd. (“FMG”) is licensed by the Malta Financial Services Authority (“MFSA”) as a category 2 Investment Services Provider as provided in the Investment Services Act Chapter 370 of the Laws of Malta. FMG is authorized to act as a full scope alternative investment fund manager (“AIFM”) in terms of Directive 2011/61/EU of the European Parliament and of the Council on alternative investment fund managers (“AIFMD”). This summary is for information purposes only and does not constitute an offer to sell or a solicitation to buy. Citizens or residents of the United States and India may not invest in these Funds. All Funds may not be marketed to Swiss citizens or residents except those considered as “regulated qualified investors” by the Swiss Collective Investment Schemes Act and the Swiss Collective Investment Schemes Ordinance. All Funds are not to be marketed to EU or EEA investors. Investors who wish to obtain information on these funds will only be provided any such materials upon receipt of an appropriate reverse solicitation request in accordance with the requirements of the EU AIFM Directive, Swiss Law and/or national law in their home jurisdiction. Opinions and estimates constitute the manager’s judgment and are subject to change without notice. Past performance is not indicative of future results. Investments in Emerging Markets should be considered high risk where a portion or total loss of capital is conceivable. The synthetic risk-indicator illustrated herein comprises 60 months returns calculated in USD and is updated once per annum. No assurance can be given that the investment objective will be achieved or that an investor will receive a return of all or part of his/her initial capital, and investment results can fluctuate substantially over any given time period. Please refer to the relative fund’s prospectus which contains brief descriptions of certain risks associated with investing in the fund. FMG funds or third-party funds marketed by FMG are aimed at experienced investors and you have to ensure you are able to invest in such funds. Questions should be directed to your local representative or financial advisor. This document may not be reproduced, distributed, or published for any purpose without the prior written consent of the manager. All information contained in this communication is as provided by FMG (MALTA) Ltd. Return chart: Asia Frontier Fund ISIN KYG0133A1186, MSCI FM Asia Index (USD). Exposure chart updated January 2020. Data Sources: Bloomberg & AFC Ltd. Copyright (C) 2022 FMG. All rights reserved